Why Manchester is a Prime Destination for Property Investment

At Britannia Estate Agents, we pride ourselves on identifying the most promising opportunities for property investors, and Manchester stands out as one of the UK’s most dynamic and rewarding cities. Renowned for its thriving economy, rich cultural heritage, and forward-thinking infrastructure, Manchester continues to attract businesses, professionals, and students from across the globe.

With a burgeoning population, extensive regeneration projects, and a reputation as the UK’s “second city,” Manchester offers a unique blend of high rental yields and strong capital growth potential. Whether you’re looking to invest in buy-to-let properties, student accommodation, or residential developments, Manchester’s diverse property market caters to all needs.

As the city continues to expand and innovate, now is the perfect time to explore the opportunities it holds for astute investors. Britannia Estate Agents is here to guide you every step of the way, ensuring your property investment journey in Manchester is both seamless and profitable. Why not review our handy property-buying tips today?

Why Invest in Manchester Buy-to-Let Properties?

Manchester has firmly established itself as one of the most attractive cities in the UK for buy-to-let property investment. At Britannia Estate Agents, we recognize the city’s immense potential to deliver strong returns and long-term value to property investors. Here’s why Manchester stands out:

Strong Rental Demand

With a population that is growing faster than the national average and a significant influx of students, young professionals, and families, Manchester’s rental market is thriving. Its reputation as a top UK city for employment opportunities and quality of life makes it a magnet for tenants seeking modern, well-located homes. Manchester’s reputation as a hub for students, young professionals, and families drives consistent tenant demand. Its world-class universities, booming job market, and vibrant lifestyle make it a highly desirable location for renters. This means fewer void periods, a steady stream of income for landlords, and a higher property valuation.

High Rental Yields

Manchester consistently ranks among the best UK cities for rental yields. Neighbourhoods like Salford, Ancoats, and Deansgate offer yields significantly above the national average, providing excellent opportunities for investors to maximize income. Manchester consistently ranks among the UK’s best cities for rental yields. Many areas, such as Salford, Ancoats, and Northern Quarter, offer yields averaging between 6% and 8%, significantly above the national average. This ensures a steady income for buy-to-let investors.

Economic Growth and Job Creation

As the core of the Northern Powerhouse, Manchester benefits from a robust economy and significant government investment. Industries like tech, finance, and media are flourishing, attracting a highly skilled workforce that needs quality housing, further boosting the rental market.

Booming Economy

As the heart of the Northern Powerhouse initiative, Manchester boasts a robust and diverse economy. With thriving industries, including technology, finance, and media, the city attracts professionals from all over the world, driving demand for high-quality rental properties.

World-Class Universities

Home to the University of Manchester and Manchester Metropolitan University, the city hosts over 100,000 students, many of whom remain in the city after graduation. This creates a steady demand for both student accommodation and homes for young professionals.

Extensive Regeneration Projects

Manchester’s skyline has been transformed by billions of pounds of investment in regeneration. Developments like MediaCityUK, NOMA, and the ongoing Northern Gateway project are creating desirable areas with excellent amenities and transport links, adding significant value to surrounding properties. Major regeneration projects like MediaCityUK, Mayfield, and Victoria North are transforming areas of Manchester, increasing property values and creating vibrant, modern communities that appeal to tenants and buyers alike.

Excellent Transport Links

Manchester’s extensive transport network, including its international airport, mainline train stations, and upcoming HS2 link, makes it one of the best-connected cities in the UK. For renters, this ease of access to work, education, and leisure is a major draw. With HS2 set to improve connectivity to London and beyond, Manchester’s appeal is expected to grow even further. This positions the city as a prime location for long-term investments that offer both income and appreciation.

Affordable Property Prices

Despite its rapid growth, Manchester remains more affordable than London and other major cities, offering investors the opportunity to enter the market at a lower price point while still benefiting from strong capital appreciation. Neighborhoods such as Levenshulme, Gorton, and Moston offer affordable property prices with the potential for significant growth. As regeneration spreads across the city, these areas are becoming increasingly desirable, offering high returns for investors willing to spot opportunities early.

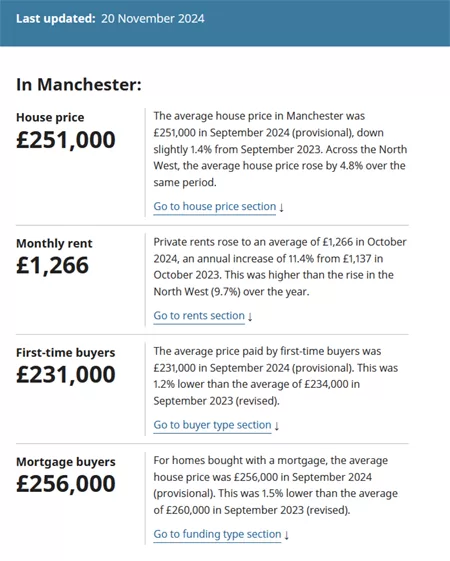

Image Courtesy of the Office For National Statistics

Liverpool vs Manchester: Which is Better for Property Investment?

Both Liverpool and Manchester are key cities in the UK’s property investment market, offering unique opportunities for investors. However, the choice between them often depends on your investment goals, such as high rental yields, capital growth, or tenant demographics. Here’s a Property Buyers Guide to review as well as a comparison to help you decide:

1. Property Prices

- Liverpool:

Liverpool boasts some of the most affordable property prices in the UK. This makes it an excellent entry point for investors, particularly those with smaller budgets or those looking for high-yield opportunities in up-and-coming areas.

Average Property Price (2024): ~£150,000 (varies by area). - Manchester:

Property prices in Manchester are higher, reflecting its status as a global city with strong capital growth potential. While the initial investment is larger, Manchester often delivers robust returns in both rental income and long-term appreciation.

Average Property Price (2024): ~£250,000 (varies by area).

2. Rental Yields

- Liverpool:

Liverpool consistently offers some of the highest rental yields in the UK, particularly in areas like L1, L3, and L6. Yields of 7%–10% are achievable in certain postcodes, making it a hotspot for buy-to-let investors seeking strong cash flow. - Manchester:

Manchester offers slightly lower yields compared to Liverpool, typically around 6%–8% in prime areas like Ancoats, Salford, and Deansgate. However, these yields are accompanied by greater capital appreciation potential, balancing out long-term returns.

3. Capital Growth Potential

- Liverpool:

While Liverpool offers affordability, its capital growth has historically been slower than Manchester’s. However, recent regeneration projects, like Liverpool Waters and the Knowledge Quarter, are driving increased demand and boosting property values. Learn more in our buy-to-let property guide to Liverpool. - Manchester:

Manchester is a leader in capital growth in the UK property market. The city has seen significant price increases over the past decade, driven by high demand, large-scale regeneration projects, and its role as the heart of the Northern Powerhouse initiative.

4. Tenant Demand

- Liverpool:

Liverpool’s tenant demand is strong, particularly among students and young professionals. Its vibrant cultural scene, renowned universities, and regeneration projects ensure a steady flow of renters. However, demand is more localized, and some areas may experience void periods. - Manchester:

Manchester enjoys a more diverse tenant base, including students, young professionals, families, and international residents. With its thriving job market, excellent transport links, and global appeal, tenant demand is consistently high across the city.

5. Regeneration and Development

- Liverpool:

Liverpool is undergoing transformative regeneration projects, including the £5 billion Liverpool Waters and the expansion of the city centre. These developments are creating new investment hotspots, particularly in North Liverpool and dockside areas. - Manchester:

Manchester’s regeneration projects are more established and widespread, with areas like Salford Quays, Northern Gateway, and Eastlands seeing extensive investment. The city’s infrastructure improvements, including HS2, further enhance its long-term prospects.

6. Investment Strategy

- Liverpool:

Best suited for investors seeking high rental yields at lower entry prices. Ideal for those focused on short- to medium-term cash flow or looking to target student and young professional markets. - Manchester:

Ideal for investors aiming for a balance of strong rental income and long-term capital appreciation. It’s a better option for those with higher budgets who want to invest in a globally recognized and economically vibrant city.

Conclusion: Which City Should You Choose?

- Choose Liverpool if:

- You want high rental yields and lower property prices.

- You are willing to invest in regeneration areas with potential for growth.

- Your focus is on maximizing short-term rental income.

- Choose Manchester if:

- You are looking for long-term capital appreciation.

- You prefer a diverse and established tenant market.

- You want to invest in a city with global appeal and economic resilience.

At Britannia Estate Agents, we’re here to help you navigate the opportunities in both cities. Whether Liverpool’s affordability or Manchester’s growth potential aligns with your goals, our expertise will ensure your investment is a success.

Are Manchester Properties Profitable for Investors?

The short answer: Yes, Manchester properties are highly profitable for investors, and the reasons are compelling. As one of the UK’s fastest-growing cities, Manchester offers a unique combination of high rental yields, strong tenant demand, and impressive capital growth, making it a top-tier destination for property investment.

At Britannia Estate Agents, we’ve seen first-hand how Manchester properties deliver consistent profitability for investors. Whether you’re interested in buy-to-let opportunities, off-plan developments, or long-term capital growth, Manchester’s property market provides the perfect balance of affordability, demand, and reward. Let us help you make the most of this vibrant and lucrative market!

We believe that Manchester’s dynamic property market offers something for every investor. Whether you’re an experienced landlord or exploring your first buy-to-let opportunity, our team is here to provide expert advice and help you make the most of what Manchester has to offer. Let’s work together to turn your investment into a success story.

Manchester Offers Diverse Opportunities for Buy-to-Let Investors

Manchester stands out as one of the most versatile property investment markets in the UK, offering a wide range of opportunities for buy-to-let investors. From catering to professionals in the city centre to accommodating families in suburban neighbourhoods, Manchester’s property market is as diverse as its population.

Manchester’s thriving business sector, particularly in areas like Spinningfields and MediaCityUK, attracts a steady influx of young professionals. High-specification apartments in the city centre, particularly in areas like Ancoats, Deansgate, and Castlefield, are in high demand, offering strong rental yields and minimal void periods. Learn more about the differences between buying a house versus buying a flat with our guide.

With its status as a global hub, Manchester attracts international students, professionals, and families. Properties that cater to this demographic, such as luxury apartments or houses in premium locations, can command higher rents and attract high-quality tenants.

At Britannia Estate Agents, we understand that every investor has unique goals. Manchester’s diverse property market ensures there’s an opportunity to match every strategy, whether you’re targeting high rental yields, long-term growth, or a niche audience like students or short-term renters. Let us guide you in finding the perfect investment opportunity to suit your portfolio.

We have created some useful property guides, from our popular Stamp Duty In Wales Guide, Property Survey Guide to our How to Buy Property in Wales guide.