Liverpool has become a popular UK destination for those looking for a shrewd property investment. House prices are lower than in southern regions of the country, but average rental yields are higher, ensuring a profitable return on investment.

Liverpool has a diverse range of buy-to-let properties available in prime locations throughout the city with high rental potential. Property investment companies in the city can offer a hassle-free service for those interested in buy-to-let properties and can help guide you through every stage of the process.

Property investment companies can be contacted for further information on their property portfolios and often offer property guides for a more detailed look at buy-to-let properties.

Why Invest in Liverpool Buy-to-Let Properties?

Liverpool’s mix of affordable property prices, high rental demand, and attractive rental yields have made it a top choice for many buy-to-let investors.

The city previously suffered from economic decline, but in the last few decades, it has transformed into a major player in the UK and is now one of the fastest-growing city regions.

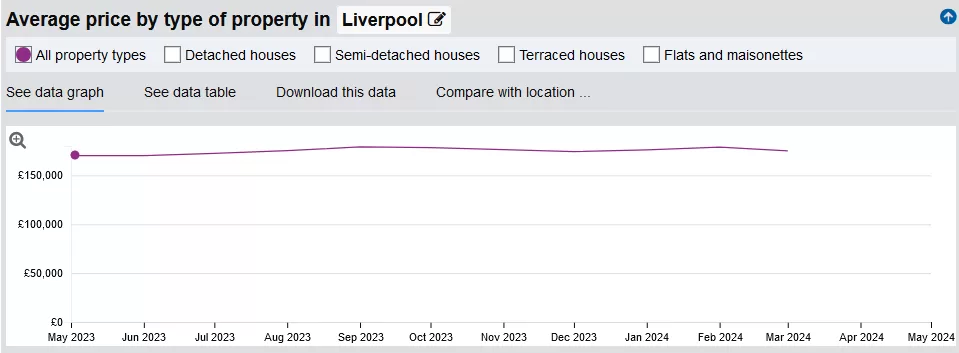

Investors are likely to see substantial returns thanks to the city’s high rental yields and potential for significant capital growth. The population in Liverpool is also forecast to grow, and the city centre population skews young (75% are 17 – 29 years old), meaning they are more likely to rent, ensuring high rental demand. We would like to thank Total Property Group for the average property

Are Liverpool Properties Profitable for Investors?

As mentioned, Liverpool is known to have a high rental yield. Zoopla puts it in the top ten highest rental yields among UK cities, with an average gross yield of 7.44%.

As advisors at Britannia Estate Agents, we’re often asked about rental yields in Liverpool, and for good reason—this city is a standout performer in the UK property market. Liverpool consistently offers some of the highest rental yields in the country, making it a prime destination for property investors seeking strong returns.

Liverpool Rental Yields Explained

In many areas of the city, yields range from 6% to 10%, depending on property type, location, and tenant demand. Hotspots such as the city centre, L1, L2, and areas like the Baltic Triangle continue to thrive thanks to their vibrant cultural scene, employment opportunities and appeal to young professionals and students.

For those looking further afield, neighbourhoods like Kensington, Toxteth, and Wavertree also offer impressive yields, especially for investors targeting the student rental market or affordable housing. These areas are seeing ongoing regeneration, which adds an extra layer of potential for capital appreciation alongside rental income.

Liverpool’s affordability is a key driver of its strong yields. With lower property prices compared to cities like Manchester or London, and consistent demand from tenants, you can achieve excellent returns on relatively modest investments. This combination of low entry costs and high rental demand is what sets Liverpool apart as a top-tier investment location.

At Britannia Estate Agents, we believe that Liverpool’s rental market offers unmatched opportunities for both new and experienced investors. Whether you’re interested in single lets, HMOs, or even serviced accommodation, we can help you navigate the market and maximize your returns.”

Feel free to reach out for a tailored consultation—we’d love to help you unlock Liverpool’s property potential! The Liverpool property investment rental yields image is courtesy of Total Property Group.

Liverpool properties are also more affordable than those in other major urban centres. According to Land Registry data, the average house price in Liverpool was £175,085 as of March 2024. This is much cheaper than the UK average house price, which was £282,776 during the same period. Liverpool is forecast to experience strong property price growth in the coming years, meaning those who look at buy-to-let as a long-term investment are likely to make significant returns.

The Buy to Let properties in Liverpool image is courtesy of RWinvest – A UK based Buy-to-let property investment company.

Liverpool Offers Diverse Opportunities for Buy-to-Let Investors

Liverpool is a thriving urban hub, home to many different types of property that can offer diverse opportunities for investors. This includes historic buildings such as those found in the stunning Georgian Quarter or the characterful Victorian warehouses. There’s also innovative and stylish new build properties on offer.

The city is popular with young professionals and students, meaning there are various demographics to target and a constant stream of new potential tenants.